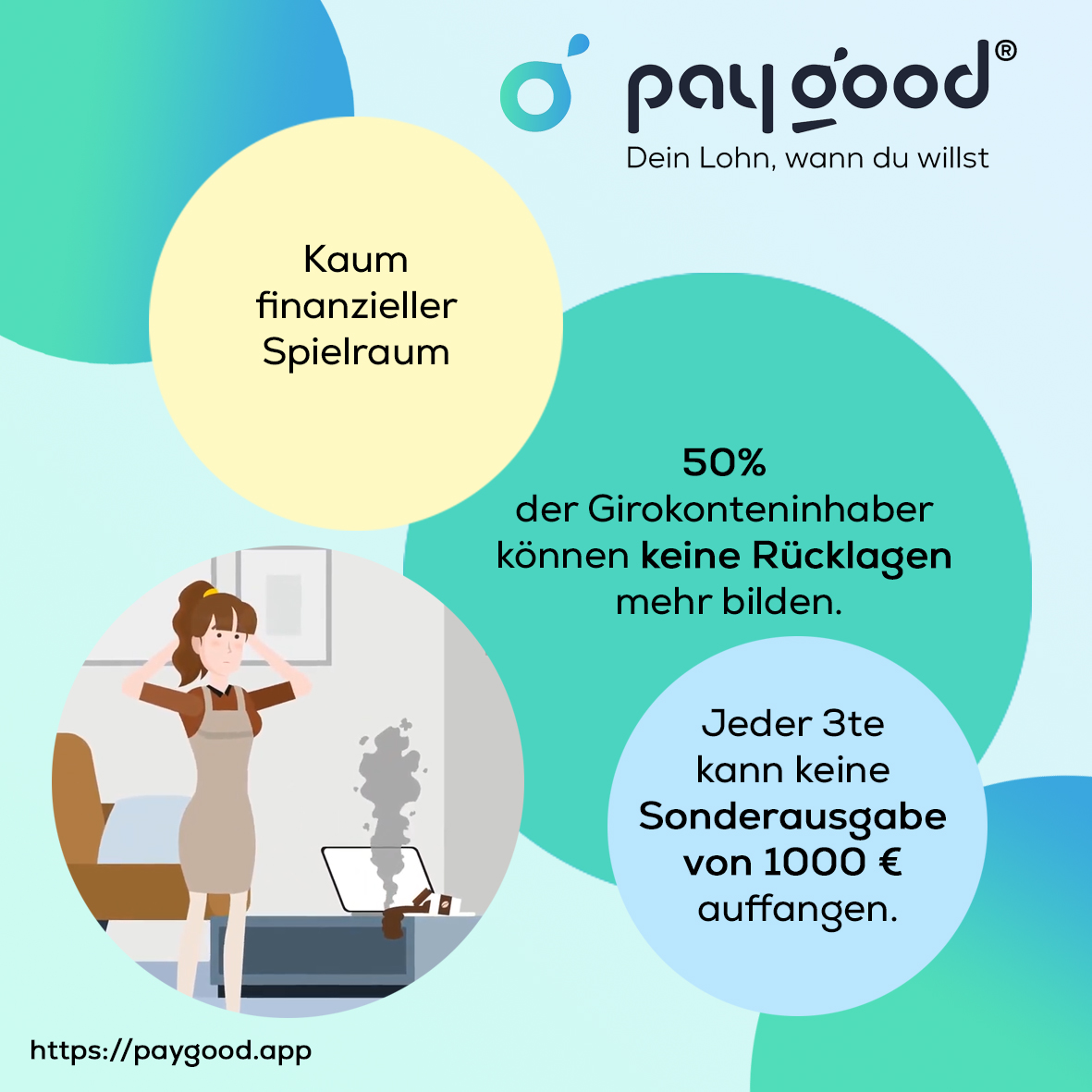

Almost one in two can no longer build up savings

21 September 2023

"Half of our customers need their entire income to cover their monthly expenses," said Peter Schneider, President of the savings banks in Baden-Württemberg. Mr. Schneider attributes this development to high inflation.

How can that be?

Real wages have been falling since Q2.2020. Even despite a nominal wage increase of (incredible) 5.6% in Q1.2023, the consumer price index rose by 8.3% in Q1.2023. The trend from 2020 is therefore continuing: high inflation is more than eroding wage growth for employees at the start of 2023. Most employees will have nothing left at the end of the month. One unforeseen expense and the employee pays for it. Despite high interest rates on loans, employees resort to their bank's overdraft facility or expensive buy-now-pay-later purchases (Klarna & Co). They have no other alternative. Or do they?

A new, innovative solution helps to avoid the costs of overdrafts and loans.

With the paygood.app, HR Improvement has developed an innovative salary payment model that gives employees the opportunity to access a portion of the money they earn at any time. With the help of our paygood.app, employees are financially flexible at all times. This gives employees more control and transparency over their finances. This demonstrably improves employees' quality of life, increases productivity and reduces staff turnover.

Have I aroused your curiosity? Please do not hesitate to contact me for further information.

Yours, Kurt Beckers

https://paygood.app by HR Improvement GmbH

Similar artciles